Renters Insurance in and around Aurora

Looking for renters insurance in Aurora?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your smartphone to furniture to books to children's toys. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Aurora?

Rent wisely with insurance from State Farm

Why Renters In Aurora Choose State Farm

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps guard your personal possessions in case of the unexpected.

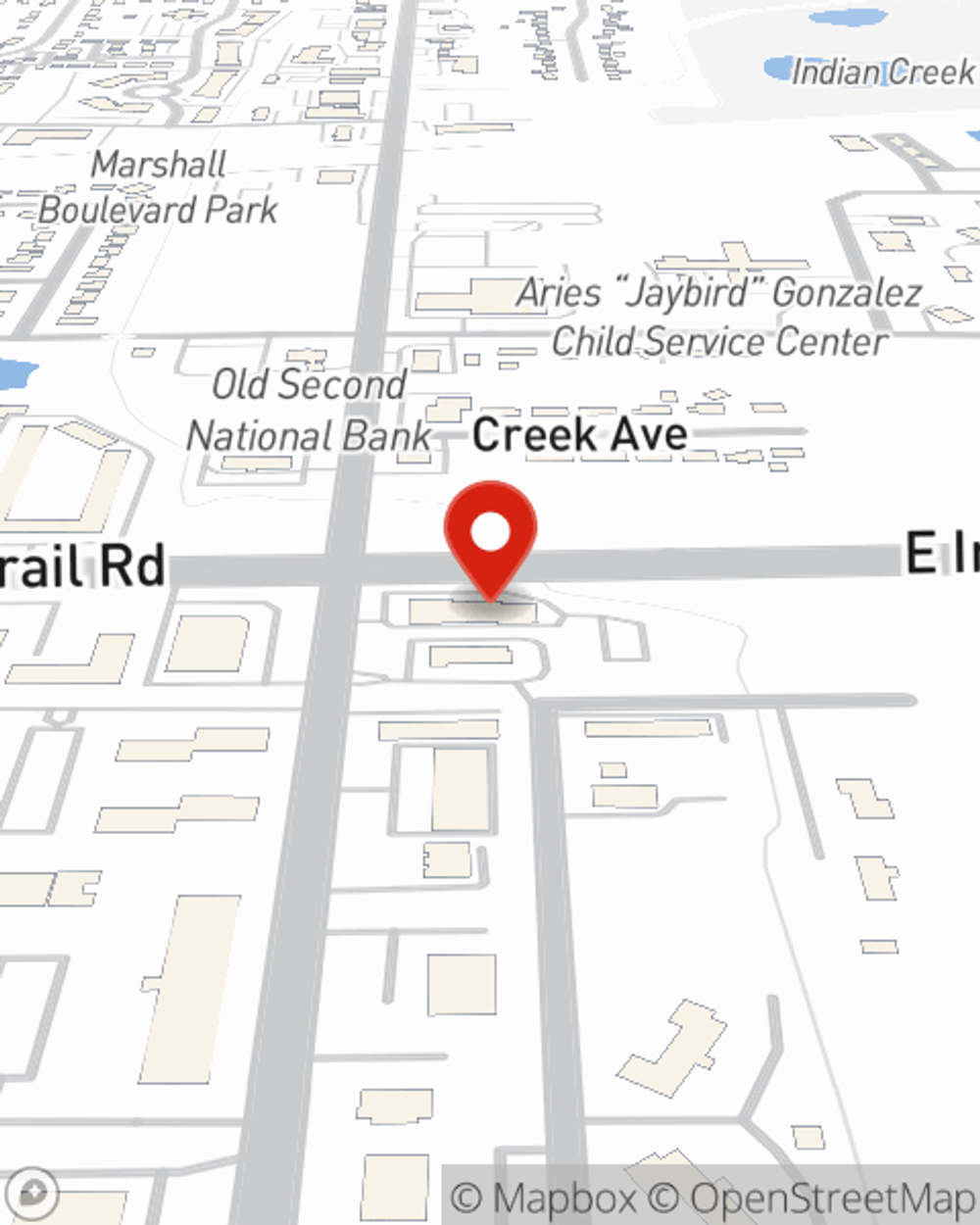

More renters choose State Farm® for their renters insurance over any other insurer. Aurora renters, are you ready to talk about the advantages of choosing State Farm? Visit State Farm Agent Brian Pool today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Brian at (630) 862-2901 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.